Biz Tax CARES Act PLR READY - here are highlights of what you need to know

Published: Tue, 02/23/21

Here's What You and Your Readers MUST KNOW Regarding Coronavirus Tax Relief When Filing Your 2020 Business OR Individual Income Taxes:

- People who were stuck home with virtual schooling kids with no options for child care may be able to take many of the CARES act tax benefits

- Business owners can get their PPP loans extended if their sales showed a decline as a result of Coronavirus

- Freelancers, side giggers and independent contractors are now entitled to unemployment compensation if Coronavirus interfered with their ability to work

- People who were forced to take early distribution of their retirement funds get to dodge the 10% tax penalty, plus pay back the amount over a 3-year period and more

- You need NOT have contracted Coronavirus to have been impacted (although if you did get the virus, the medical proof counts in your favor).

- You ALSO do not need any type of "official certification" that your business or personal income was affected by the pandemic. All you have to do is make your needs known to your tax preparer and have the benefits applied to your situation.

This information can be yours to share these important tips with people who look to you as an authority on business related topics. It's a great starting point to get their questions answered in a general way. I've included a ton of links that direct back to the IRS website where they can find the full details and latest updates, and get help for their specific situation.

This pack has more than 8500 words, with private label rights to sell or share as your own. Here's the page where you can learn everything you need to know about what's included.

THIS INFORMATION IS REALLY IMPORTANT FOR ALL OF US!

Use it to build your business, grow your audience and profit. If you're a tax preparer, disseminating these details will give people confidence in your ability to help them. If you're a business owner, this content will push your good name farther out there.

Use it to help people - everyone wants and NEEDS these coronavirus tax relief tips. Many don't even know these tax benefits are available to them!

Use it to help yourself! I know that my family is going to benefit from this information. We have all been dealing with SO MUCH - and the US government is HELPING people through the horrors of the Coronavirus quarantine!

Publishing suggestions and tips:

- Make into an ebook download and offer as an opt-in gift to grow your list

- Share with paying clients and monthly members

- Publish the tips one by one in your blog

- Let your friends who are tax preparers know that this content is available to offer their readers

- Share the tips in your email newsletter

- Publish the information on social media

- Use the content to help you get new traffic to your website or blog

- Run a short workshop for your clients and use the content as a guideline for your talking points

- Anything else you can think of!

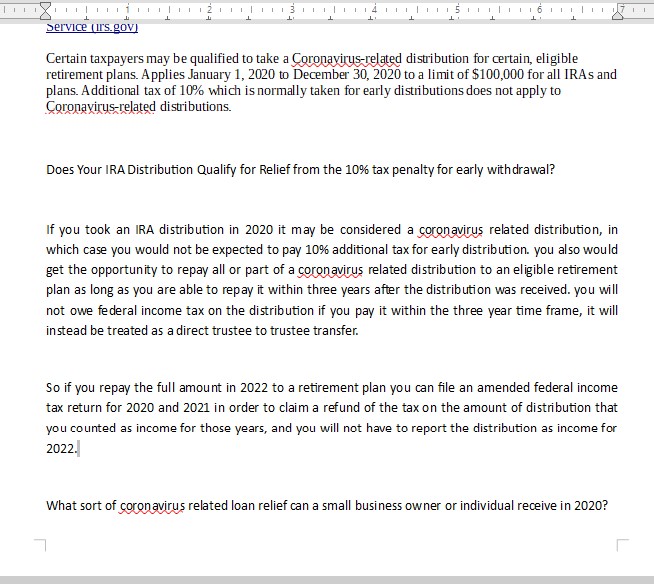

Here's a screen shot:

Learn more and order right here. Don't forget your coupon code, CARESACT, for $20 off if you decide to pick this up ala carte. Or, get it after you sign up for the Business PLR Monthly. Both options are available from that page.

Thanks for being here! Wishing you great success and prosperity in 2021 and beyond. And I REALLY hope you get to use those tax breaks! We ALL need this. God bless!!

Dina at Wordfeeder PLR